The Ultimate Guide to Forex Trading Platforms 1941825157

The Ultimate Guide to Forex Trading Platforms

Forex trading platforms are the gateways to the global forex market, empowering traders with the tools and functionalities needed to make informed trading decisions. In recent years, the proliferation of online trading platforms has transformed the landscape of forex trading. In this guide, we will delve into the intricacies of selecting the right trading platform that caters to your trading style, level of experience, and individual needs. For an in-depth look at some of the platform trading forex Best MT5 Platforms, keep reading.

Understanding Forex Trading Platforms

A forex trading platform is software used by traders to place trades, monitor market movements, and analyze trends. These platforms vary in terms of functionalities, features, and user interface, making it essential for traders to choose one that aligns with their trading philosophy. A well-designed platform can enhance trading efficiency, while a poorly constructed one may hinder your performance and profitability.

Key Features to Look For

When searching for a forex trading platform, consider the following key features that can greatly influence your trading experience:

- User Interface: A clean, intuitive interface ensures that you can navigate the platform easily and execute trades quickly.

- Execution Speed: Fast order execution can be the difference between profit and loss in a volatile market.

- Technical Analysis Tools: Access to charts, technical indicators, and news feeds can help you make informed trading decisions.

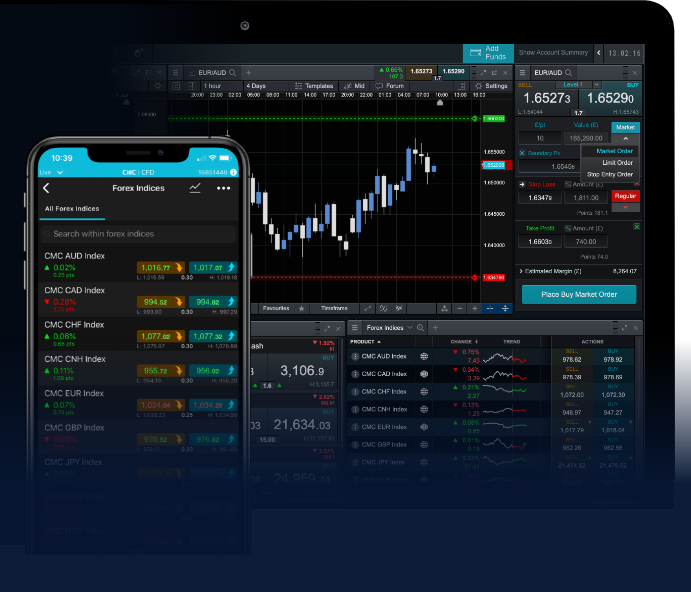

- Mobile Compatibility: A mobile trading app allows you to manage your trades on the go, providing flexibility to react to market changes promptly.

- Customer Support: Responsive customer service is crucial, especially when dealing with issues that can affect your trading.

- Security Measures: Look for platforms that employ robust security protocols to protect your personal and financial information.

Types of Forex Trading Platforms

Forex trading platforms can generally be categorized into three main types:

1. Web-Based Platforms

Web-based platforms are accessible through your web browser without requiring any downloads. They offer flexibility and are ideal for traders who need to access their accounts from multiple devices. However, they may have fewer features compared to desktop applications.

2. Desktop Platforms

These platforms must be downloaded and installed on your computer. They typically offer a more comprehensive set of tools, customizable interfaces, and advanced trading functionalities. Desktop platforms are preferred by professional traders who require a richer trading experience.

3. Mobile Platforms

Mobile trading platforms allow you to trade on the go using your smartphone or tablet. They are designed for convenience and typically offer essential trading features and functionalities but may be limited compared to their desktop counterparts.

Popular Forex Trading Platforms

Several trading platforms have gained widespread acclaim among traders, each offering unique features tailored to different trading styles. Here are some of the most popular forex trading platforms in the market:

- MetaTrader 4 (MT4): Particularly favored by retail traders, MT4 offers a user-friendly interface, advanced charting options, and a plethora of technical indicators.

- MetaTrader 5 (MT5): The successor to MT4, MT5 comes with enhanced features such as updated charts, additional order types, and built-in economic calendars. You can check out Best MT5 Platforms for more insights.

- cTrader: Known for its modern interface and advanced trading features, cTrader is favored by high-frequency traders and those focused on algorithmic trading.

- NinjaTrader: This platform is renowned for its advanced charting capabilities and trading analytics, making it ideal for serious traders dedicated to performance.

Choosing the Right Forex Trading Platform

Selecting the right forex trading platform requires careful consideration of your individual needs and trading goals. Here are some factors to contemplate:

- Your Trading Style: Are you a day trader or a long-term investor? Different trading styles may benefit from different platforms.

- Regulatory Compliance: Ensure that the platform adheres to regulatory standards of your region for safety and security.

- Cost Structure: Understand the fee structure, including spreads, commissions, and overnight fees, which can impact your overall profitability.

- Demo Account Availability: A demo account allows you to test the platform with virtual funds before committing your own, providing a risk-free way to assess its features.

- User Reviews and Ratings: Research the experiences of other traders with the platform to assess reliability and performance.

Conclusion

Forex trading platforms play a crucial role in the success of your trading endeavors. By taking the time to evaluate your options and consider the different features available, you can select the best platform that aligns with your trading strategy. Remember, the right platform not only enhances your trading performance but also provides the necessary tools to navigate the complexities of the forex market. With the information provided in this guide, you are now better equipped to embark on your forex trading journey and maximize your potential in the global currency market.